Why Muji Is Booming Again: The Strategic Revival Behind Japan’s Minimalist Brand

Japanese pop culture news edited by Patrick Macias

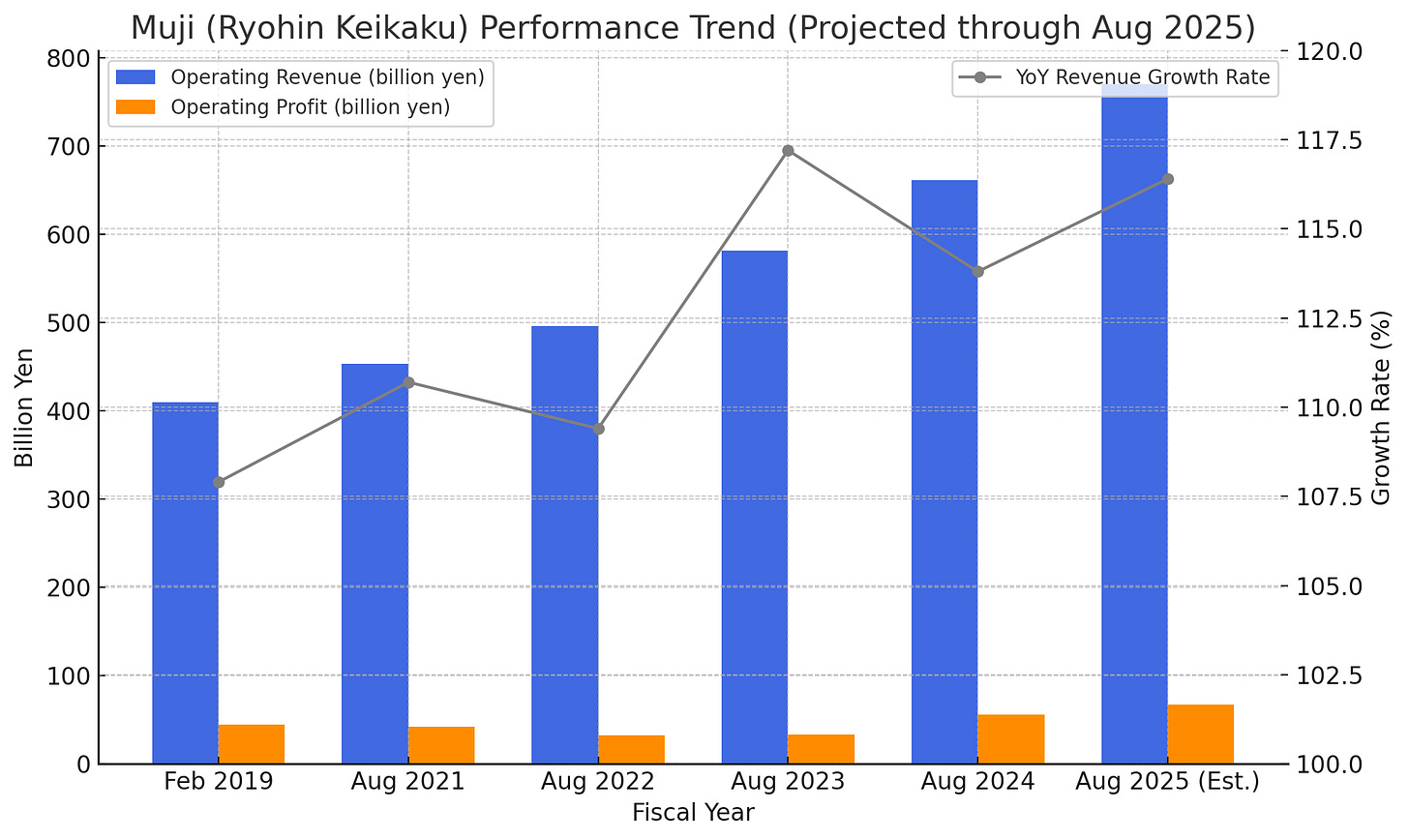

Muji’s 2025 sales are expected to hit 770 billion yen (approx. $4.9 billion), up 16% year-over-year.

The company is expanding its signature 600-tsubo (approx. 21,000 sq ft) store format both in Japan and abroad.

Cosmetics and houseware are now Muji’s main growth drivers, especially among female customers.

In recent years, more people in Japan are returning to Muji (short for Muji Ryohin, or “no-brand quality goods”). The brand that once seemed overshadowed by competitors is now experiencing a boom. Its stores are busier, its shelves better stocked, and its products, especially skincare, cosmetics, and daily household goods, are driving repeat visits.

This isn’t just anecdotal. Muji’s parent company, Ryohin Keikaku, hit an all-time high stock price on May 30, 2025. For the fiscal year ending August 2025, Muji expects sales of 770 billion yen (approx. $4.9 billion), an increase of 160 billion yen (approx. $1 billion) over earlier forecasts. Operating profit is projected at 67 billion yen (approx. $430 million), up 19%, with net profit at 45.5 billion yen (approx. $290 million), a 9% increase.

So what’s behind this sharp turnaround from earlier struggles with overseas performance and stagnant domestic growth? The answer lies in Muji’s refined store expansion strategy and a laser focus on fast-moving consumer goods.

The Growth Engine: Bigger Stores, More Locations

Since 2023, Muji has added over 110 new stores annually. This rapid growth in physical locations has been crucial to its overall performance. What’s even more impressive is that revenue growth is outpacing store count. In 2019, average sales per store stood at 440 million yen (approx. $2.8 million). By 2024, that number had climbed to over 500 million yen (approx. $3.2 million).

At the heart of this success is Muji’s 600-tsubo (about 21,000 square feet) large-format store, which has become a blueprint for profitability. These stores are now being rolled out internationally, with Taiwan, Korea, and the Philippines as the next frontiers.

Muji vs. Nitori: Who’s Winning the Lifestyle Retail Race?

Nitori, often considered Muji’s closest competitor, also sells furniture, household goods, and apparel. While Nitori has long enjoyed rising revenue, 2025 marked its first dip in profits. Muji, on the other hand, has posted double-digit growth in revenue, operating profit, and net profit year-over-year.

Keep reading with a 7-day free trial

Subscribe to TokyoScope by Patrick Macias to keep reading this post and get 7 days of free access to the full post archives.