The Hello Kitty Comeback: Sanrio’s Three Secrets for U.S. Success

Japanese pop culture news edited by Patrick Macias

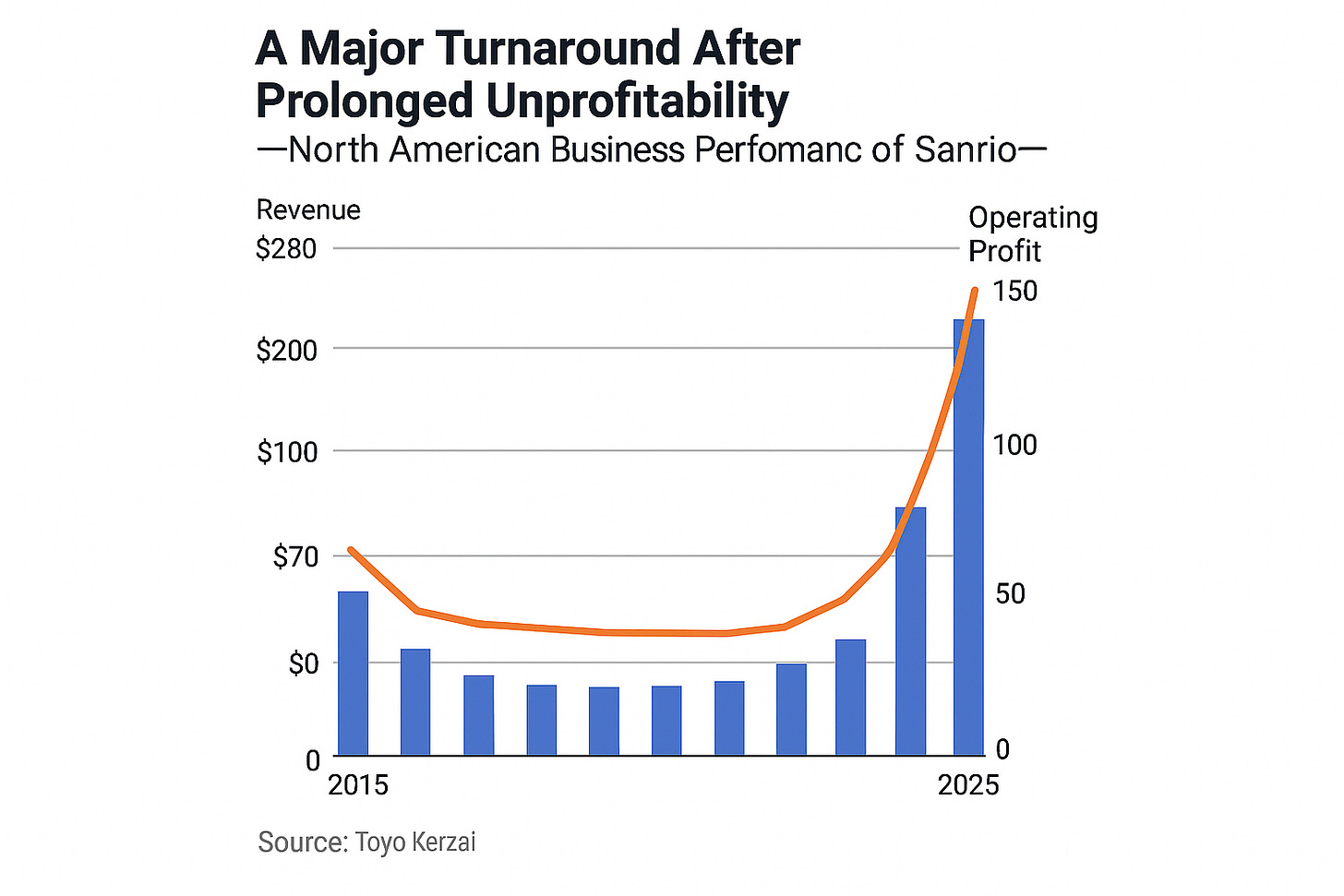

Sanrio’s North American division went from six consecutive years of losses to record profits through a major overhaul.

Strategic focus on digital marketing, stronger licensing partnerships, and global brand reform fueled the recovery.

Company-wide profits soared to 51.8 billion yen (approximately 330 million USD) with market value reaching 1.6 trillion yen (approximately 10.3 billion USD).

Once stuck in a cycle of layoffs and losses, Japan’s Sanrio company has staged a dramatic comeback in the United States, the world’s largest character goods market and the home turf of Walt Disney. The company’s recent turnaround did not happen by chance. It was driven by three major strategic shifts that transformed its struggling North American business into a powerful new growth engine.

In its latest earnings report for the fiscal year ending March 2025, Sanrio posted record numbers: sales rose 45 percent year over year to 144.9 billion yen (approximately 930 million USD), while operating profit nearly doubled to 51.8 billion yen (approximately 330 million USD). That is 3.5 times more revenue than in fiscal 2021, when the company was still in the red, and its market value has ballooned to 1.6 trillion yen (approximately 10.3 billion USD), twelve times higher than just four years ago.

The North American division played a major role in that growth. Focused on licensing popular characters like Hello Kitty to mass retailers and fashion brands, Sanrio’s U.S. business brought in 27.6 billion yen in sales (approximately 177 million USD), up 120 percent, and an all-time high of 8.9 billion yen in operating profit (approximately 57 million USD), up 213 percent. Once a drag on the company, losing money for six consecutive years through 2022, it has now become a core pillar alongside the domestic market.

From Hello Kitty Craze to Frozen Fallout

Sanrio’s North American story has not always been smooth. In the early 2010s, the Hello Kitty brand reached peak popularity, buoyed by global celebrity fans like Lady Gaga. Licensing requests poured in. “At the peak, the phones wouldn’t stop ringing. We couldn’t keep up with checking all the products,” recalls Keisuke Miyajima, Sanrio America’s CFO, who joined the company in 2018.

But things quickly changed in 2013 after Disney’s Frozen took the world by storm. Retail giants like Walmart and Toys “R” Us replaced Hello Kitty on their shelves with Frozen merchandise, and Sanrio’s sales plummeted almost overnight.

In response, Sanrio began restructuring its U.S. operations in 2018 under then-executive Tomokuni Tsuji, now company president and the grandson of founder Shintaro Tsuji. The company implemented three rounds of layoffs, closed its San Francisco headquarters, and exited the direct-to-consumer retail business in the United States. Staff numbers at the local subsidiary dropped from about 120 to roughly one-third of that. A sense of urgency finally took hold, and from that low point came three major strategic changes.

1. Going Digital With Storytelling

Unlike Disney characters, Sanrio’s lineup including Hello Kitty and My Melody does not originate from movies or television shows. While this gives the company more design flexibility and licensing freedom, it also makes it harder to compete with characters that have well-known stories behind them in the U.S. market.

Producing feature films or long-form animation was not realistic from a cost perspective. Instead, Sanrio took a grassroots approach, leaning into digital content. They began using YouTube and other social media platforms to deliver short, story-driven content. This allowed the brand to build personality and emotional connection around its characters quickly and affordably. Online communities also filled the gap left by shuttered retail stores, offering a way to directly track trends and consumer feedback.

2. Rethinking Licensing Partnerships

Another key change came in how Sanrio handled its licensing strategy. The company scaled back the number of licensees from over 230 to around 190. “We’re no longer just chasing short-term sales,” says Miyajima. “Now we focus on partners who can elevate the brand with us.”

The top 20 percent of these partners are now treated as key licensees, working closely with Sanrio on everything from product quality to new releases and marketing strategy. Rather than flooding the market, the company has focused on increasing brand visibility in a way that does not dilute character value.

3. Strengthening Global Branding from the Top Down

While the North American team was executing these reforms on the ground, Sanrio headquarters was undergoing a larger transformation aimed at reinforcing global brand strength. This company-wide effort became the third major pillar of the turnaround strategy.

Sanrio has already reached ambitious goals such as 50 billion yen (approximately 320 million USD) in operating profit and a 1 trillion yen (approximately 6.4 billion USD) market capitalization, milestones originally set for ten years in the future. Despite this, during the May earnings briefing, President Tsuji stated, “We are still far from where we ultimately want to be.”

Finding a successful model in the United States may become the foundation for even wider global expansion. For Sanrio, the real comeback may be only just beginning.